If we operate on the assumption that everybody would rather have more money than they have currently, and investment is a historically proven method of increasing wealth, then we could logically expect that everybody would partake in investment. As this is not the case, we can intuit that there is perhaps a perceived determinant to this money-making activity; a deterrent so significant that many people will decide not to invest at all, and condemn themselves to a death by 1000 cuts; sitting in cash and subjecting their savings to inflation and a never-ending loss of purchasing power. The deterrent we speak of is risk. Or what people perceive to be risk. An Oxford English dictionary defines it as “The possibility that something unpleasant or unwelcome will happen”. This is a reasonable explanation. The risk when crossing the road without looking is that you will be hit by a car. The risk when driving a car under the influence of alcohol is that you will crash the car (or hit the person crossing the road, who has stepped out without looking!). Clearly, these are activities in which we should not partake. They pose huge, asymmetrical risk with no reward. With investment however, we know that there is potentially a significant reward, so how can be reduce the barrier to entry- risk?

For investors, is this definition of risk sufficient? We would proffer that yes, yes it is. The problem that may arise when discussing risk in the context of investment is that more often than not investors equate risk directly with loss. With failure; with the scenario where at a given time their investment is worth less than it was originally. The moment that “risk” gets brought into the conversation with the advisor the investor is already in damage-control mode, wincing in pain and likely already regretting the investment that they have not yet made. This is a mistake. Unless risk has been objectively defined in conversation, it will be impossible for the advisor to serve the client, and impossible for the client to understand the performance of their investments without first jumping to the conclusion that a temporary loss in value is a failure; brought about with the wrongful engagement of risk. To reduce risk, you must first understand what it is, and how to measure it.

What Is Risk In Investment And What Methods Reduce It?

In the vehicular scenarios above it is impossible to draw a comparison between the types of, and objectively quantify, the risk engaged in by the driver, and our hapless pedestrian. The scenarios share a theme, but we are unable to mathematically calculate their risk in such a way as to be able to usefully compare the two. Securities investments in all genera are all measurable with the same tool; “standard deviation” (“SD” for short or “σ” if you like Greek). If we are to propose that in investments, risk is the standard deviation of an instrument then we are on much more stable ground than the emotional knee-jerk notion that investment risk is that of “losing money”. It is the common desire to avoid “losing money” that results in billions of people avoiding this “risk” the only way they conceivably can- by not investing at all. In the situation where the individuals understanding of risk is limited to this emotional response, not investing is indeed, the most appropriate strategy…

For the informed, the standard deviation measurement is going to be the first port of call to determine how “risky” an asset is. The utility of this measurement is spelled out in its name as we are being told that it is a measurement of how much the results or readings of this thing (in our case, an investment), deviate from what we expect to be the standard (in our case, the most common return over a given period)- how much does it deviate from the standard? From its “norm”?

Standard deviation is the most commonly used measure of dispersion. As a measure of dispersion it gives us information about the statistical probability of returns being different from the mean, or most common return, from our investment. For example, if we have a fund that has a mean (or average) annual return of 6% and a standard deviation of 2% then we can expect (given a normal distribution) that two thirds of the time (68% of the time) the fund will produce between 4% and 8% and that 95% of the time it will produce a return between 2% and 10%. Now, this does not enable us to predict the exact return of the fund in the future, but it does give us range of returns that we can expect, with a measurement of probability based on past performance. There are caveats. Equity funds do commonly do not produce data with a “normal” distribution as there is a tendency to produce more positive returns over time (we could argue that this is due to them having a historical tie to inflation, which over the long-term only moves one way), and there are many hedge funds which, owing to their esoteric strategies, may produce very irregular distribution data. You also may be limited by the availability of data points; the investment is relatively new or pricing is problematic etc.

These limitations aside, we work with what we have. Looking back on our dictionary definition of risk as “The possibility that something unpleasant or unwelcome will happen”, standard deviation measures enable us to objectively calculate the probability of us getting a return that is “unwelcome”, given the normal returns of the investment at hand. Commonly, you will note patterns between SD and asset class; a blue chip equity fund is going to have a lower SD than an emerging market equity fund, but will still have a higher SD than a corporate bond fund. It is through the lens of standard deviation that we are able to objectively compare asset classes in common terms, facilitating the prudent planning of portfolio risk- as after-all, without risk, there is no return. The goal however, is not to reduce risk to zero. It is actually those who do not participate in investment at all that are subject to the most “unwelcome” of financial outcomes…

- Your money is subject only to inflation

- If you do not beat inflation with investments your money loses purchase power

- Losing purchase power is equivocal to losing money as they both result in a reduced ability to consume, and buy goods and services

- An aversion to the “risk” of losing money is the main reason cited by people who do not invest…

For those currently protecting their wealth with investment, the irony of this will not be lost upon you.

Reducing risk by being aware of, and managing the potential volatility of your investments is a simple strategy that yields significant results. Unfortunately you cannot simply look at the standard deviation of a basket of investments or portfolio. When considering the portfolio as a whole you must first address the correlation between the constituent parts (the different investments) of the portfolio. The volatility of the portfolio will be the sum of the volatility of its different parts, and if your portfolio is designed properly then you will have investments which move independently of one another, so that you are sufficiently diversified, and not overly exposed to any one asset class or geographic region. Historically correlations increase during bear markets, but once again, making provisions for the “unwelcome” situations forms the basis of prudent financial planning and is often the difference between a losing and a winning strategy.

How Can An Understanding Of Standard Deviation Help To Reduce Portfolio Risk?

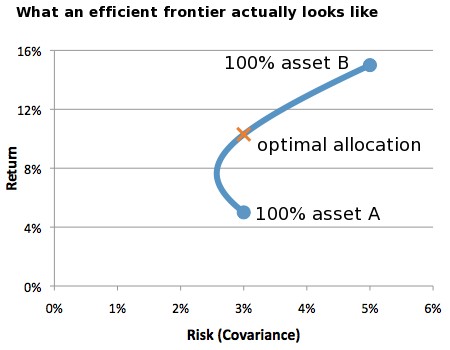

As mentioned previously, SD alone will not be sufficient to manage risk at portfolio level, but it will form a useful base upon which to build. One way to benefit from standard deviation measures is by using the efficient frontier model. This method permits an investor to maximise returns for a given level, or budget, of risk ( lets call that volatility). To calculate this we require the expected return of the assets (ordinarily the mean return) and and the co-variance of the assets; the measurement of the extent to which they move together, or independently of each other. For any theoretical pair of assets there is a perfect mix or balance of allocation between the two assets at which point the investor achieves the maximum possible return with the lowest amount of volatility (standard deviation). Imagine mixing the perfect cocktail. Too much of a single ingredient and the drink is ruined. Too much of another ingredient and it ceases to be the drink you ordered. Proper risk-profiling procedures before investing will ensure that your advisor is showing you the right menu for your appetite and will enable you to reduce the risk of investing in risky assets. Being aware of the standard deviation of different assets will enable you to make more prudent decisions when managing your money. “Surprise me” is a phrase sometimes heard at bars, never at banks…